.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of .75″ />.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of

.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of .75″ />.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of

.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of .75″ />.75″ />.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of

.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of .75″ />.75″ />.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of

.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of

.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of  .75″ />.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of

.75″ />.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of

.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of

.75 Dividend” title=”Gilead Sciences ( GILD ) announced a dividend of  .75″ />.75″ />.75″ />

.75″ />.75″ />.75″ />On April 27, 2023, Gilead Sciences announced that its board of directors had declared a regular quarterly dividend of $0.75 per share ($3 y/y). The company previously paid $0.75 per share.

To receive the dividend, shares must be purchased by the ex-dividend date of June 14, 2023. Shareholders of record on June 15, 2023 will receive the payment on June 29, 2023.

At the current price of $82.21 per share, the dividend yield is 3.65%.

Looking back five years and the weekly sample, the average dividend yield was 3.93%, with a decrease of 2.92% and an increase of 5.02%. The standard deviation of performance is 0.49 (n = 237).

The current return is 0.57 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 0.67. The payout ratio tells us how much of a company's earnings is paid out as dividends. A payout ratio of one (1.0) means that 100% of the company's earnings are paid out as dividends. A payout ratio greater than one means that the company is investing in savings to maintain profits, which is not a good situation. Companies with little growth potential should pay out most of their income in the form of dividends, which usually means a payout ratio of 0.5 to 1.0. Companies with good growth prospects should set aside a portion of their profits to invest in those growth prospects, which correspond to payout ratios between zero and 0.5.

The company's 3-year earnings growth rate is 0.10%, which indicates that the company has increased its earnings over time.

Learn how to generate income

buying shares. Take profit. stock sale. Repeating this is the essence of collecting profits, and you can easily do this with Fintel's profit collection calendar.

What's the mood in the box?

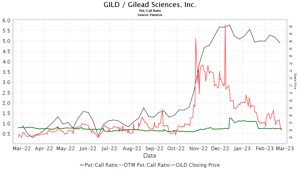

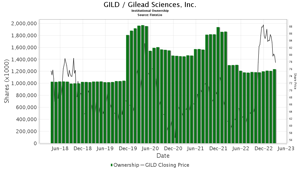

Laad Sciences has 2,920 institutions or organizations offering positions. Last quarter there were 165 owners, an increase of 5.99%. The average portfolio weight of all GILD special funds is 0.49%, up 0.76%. The number of shares owned by institutions increased by 2.20% over the past three months and amounted to 1,236,359 thousand shares.  © Fintel GILD / Courtesy of Gilead Sciences, Inc. Buy/Sell Ratio GILD has a buy/sell ratio of 0.75, indicating a bullish outlook.

© Fintel GILD / Courtesy of Gilead Sciences, Inc. Buy/Sell Ratio GILD has a buy/sell ratio of 0.75, indicating a bullish outlook.

Analysts' forecasts of potential price growth are 12.15%.

As of April 24, 2023, the average annual target price for Laad Sciences is $92.20. Forecasts range from $78.78 to $120.75. The average target price represents a potential upside of 12.15% from the last published close price of 82.21.

Check out the ranking of companies with the highest growth potential.

Gilead Sciences reported annual revenue of $26.046 billion, down 3.69%. Estimated annual non-GAAP EPS is 6.89.

What are other shareholders doing?

© Fintel GILD / Courtesy of Gilead Sciences, Inc. Shares owned by organizations

© Fintel GILD / Courtesy of Gilead Sciences, Inc. Shares owned by organizations

Capital World Investors owns 68,893,000 shares or 5.52% of the company. In previous filings, the company said it had 57,763,000 shares , up 16.16%. The company increased GILD's stake in the portfolio by 57.58% over the last quarter.

Capital Research Global Investors owns 54,603,000 shares or 4.37% of the company. In previous filings, the company said it had 53,875,000 shares , up 1.33 percent. The company grew its stake in GILD's portfolio by 29.74% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Investors owns 38,125,000 shares or 3.05% of the company's stock. In previous filings, the company said it has 37,378,000 shares , an increase of 1.96%. The company increased GILD's stake in the portfolio by 31.08% over the last quarter.

Dodge & Cox owns 35,885,000 shares or 2.87% of the company. In previous filings, the company said it had 36,369,000 shares , down 1.35%. The company grew its stake in GILD's portfolio by 24.27% over the last quarter.

AMECX – American insider fund owns 32,377,000 shares or 2.59% of the company. In previous filings, the company said it had 28,765,000 shares , an increase of 11.16%. The company grew its stake in GILD's portfolio by 14.18% over the last quarter.

Background information for Gilead Sciences

(This description is provided by the company).

Gilead Sciences. is a biopharmaceutical company that has been advancing medicine for more than three decades to create a healthier world for all. The company is committed to advancing innovative medicines for the prevention and treatment of life-threatening diseases, including HIV, viral hepatitis and cancer. Gilead operates in more than 35 countries and is headquartered in Foster City, California. Shares of Gilead rallied, particularly in the healthcare sector, after the company brought its first treatments to market. Thanks to global partnerships, Gilead's medicines are now available to millions of people in low- and middle-income countries around the world. In the United States, over a 10-year period, Gilead has donated more than $100 million through the COMPASS initiative to community organizations fighting HIV in the southern United States. In 2020, Gilead launched the Racial Equality Community Impact Fund to support organizations working to combat racial inequality affecting black communities in the US.

This story originally appeared on Fintel.