Go to Life Sciences, Inc. If you want to know who controls (NASDAQ: ACHV ), you'll have to look at the composition of its stock register. With a 56% stake, individual investors own the majority of the company's shares. In other words, the group faces most of the upside potential (or downside risk).

Institutions in turn represent 43% of the company's shareholders. Large companies tend to have institutions as shareholders and we often see insiders owning shares in smaller companies.

Let's dive into each type of owner at Achieve Life Sciences, starting with the table below.

See our latest analysis of Achieve Life Sciences

What does institutional ownership tell us about outcomes in the life sciences?

Institutional investors often compare their returns to the returns of an index they typically track. Therefore, they often consider buying larger companies included in the standard.

As you can see, institutional investors have a large stake in Achieve Life Sciences. This may indicate that the company has some credibility in the investment community. However, it is best to avoid trusting institutional investors in the supposed validation that comes with it. Sometimes they are even wrong. It is not unusual to see a sharp drop in the stock price if two large institutional investors try to sell a stock at the same time. So it's worth taking a look at Achieve Life Sciences' past earnings history (below). Of course, keep in mind that there are other factors to consider.

Hedge funds do not own many shares of Achieve Life Sciences. Our records show that B. Riley Capital Management, LLC is the largest shareholder with a 20% stake. By comparison, the second and third largest shareholders own approximately 7.6% and 3.1% of the shares.

Based on our ownership data, 25 major shareholders collectively own less than 50% of the share register, meaning that no one person owns a controlling interest.

While it makes sense to look at data on a company's institutional ownership, it also makes sense to look at analyst sentiment to see which way the wind is blowing. Few analysts cover stocks, so you can analyze the projected growth quite easily.

Achieve primary life sciences property

The definition of inside information can be subjective and varies by jurisdiction. Our data reflect individual insider information, capturing at least board members. Management is ultimately accountable to the board of directors. However, it is not uncommon for managers to be board members, especially if they are founders or CEOs.

Most view insider ownership as positive because it can indicate that the board is well connected to other stakeholders. However, sometimes too much power accumulates within this group.

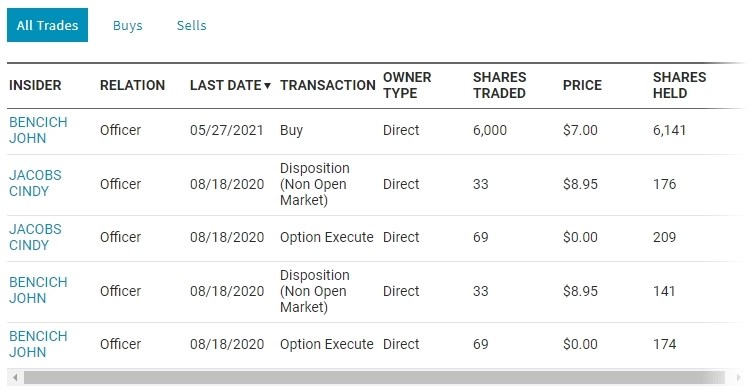

Our most recent data shows that board members own less than 1% of Achieve Life Sciences, Inc. Board members appear to own no more than $883,000 in stock in the $104 million company. Many small business investors prefer to see a larger investment chart. You can click here to see if these experts are buying or selling.

general public property

The general public, consisting primarily of individual investors, collectively owns 56% of Achieve Life Sciences' stock. This level of ownership gives traditional investors some power to change key policy decisions, such as board composition, executive compensation and dividend payout rates.

Next steps:

It is always useful to think about the different groups that own shares in a company. But to better understand Achieve Life Sciences, we need to consider many other factors. Please note that Achieve Life Sciences shows 4 warning signs in our investment analysis , 2 of which should not be ignored…

If you're like me, you may wonder if this business will grow or shrink. Fortunately, you can check out this free report that shows analysts' predictions for the future.

NOTE: The figures in this article are calculated using data for the last twelve months, covering the 12-month period ending on the last day of the month following the balance sheet date. This may not be consistent with the reported data for the full year.

Have an opinion on this article? Worried about content? Contact us directly. You can also email the editorial staff at (at)Simplywallst.com.

This article on Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies and our articles are not intended to be financial advice. It is not a recommendation to buy or sell shares and does not take into account your financial objectives or situation. Our goal is to provide focused long-term analysis based on fundamental data. Please note that our analysis may not take into account recent company forecasts based on price or quality data. Simply Wall St has no position in the stocks mentioned.

Participate in a paid user research session

You'll receive a $30 Amazon gift card for one hour of your time, which will help us create better investment vehicles for individual investors like you. register here