© Provided by TheStreet

© Provided by TheStreet

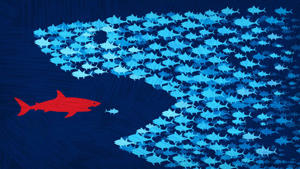

There are rumors on social media that Exact Sciences will buy Invitae. Investors should stop dreaming.

One of the most important lessons learned from the stock market correction is that the power of positive thinking can only push investors so far.

For Invited Shareholders ( NVTA ): Get the Invited Corporation report , this can lead to even more pain and suffering.

As genetic testing stocks fall, some investors predict that a larger competitor such as Exact Sciences ( EXAS ), reported by Exact Sciences Corporation , will step in and buy Invitae on the cheap.

The speculation may seem plausible given that rumors of a possible merger were circulating in August 2021.

However, hopes for such a deal seem unlikely given investors' assessment of the difficult operating environment affecting all companies and the promising performance of its larger peer.

Profits are the next big thing

Invitae embodied the "growth at any cost" business model that became common at a time when interest rates were extremely low.

Flaws in the company's approach were exposed almost as soon as Wall Street began to assess the impact of rising interest rates. Shares of the genetic testing company are down 83% in 2022.

Investors are aware of the company's performance and recovery, including lower growth expectations, issuing service bills to 33% of its employees and replacing the CEO.

The company expects sales to be flat in 2023. If sales pick up again in 2024, annual growth could be less than half of previous promises.

Some important nuances are lost in the acquisition speculation. One detail is that the work environment of the genetic testing industry has changed. Sema4 ( SMFR ) , 23andMe ( ME ) – Get 23andMe Holding Co. Report and other colleagues also vowed to abandon the incremental business model at all costs.

Exact sciences have never used such an approach. It wasn't meant to be. The company relies on colorectal cancer screening tool Cologuard, which last year was the first and only diagnostic product to generate at least $1 billion in annual sales. The flagship continues to grow at more than 20% per year despite, or perhaps because of, its size.

However, management promised to be profitable by 2024 based on adjusted EBITDA. The main difference between Exact Sciences and its competitors is that this promise was announced before the stock market started to wobble. Even if not, Wall Street will likely demand more efficient operations given the growing macroeconomic uncertainty.

For this reason, Exact Sciences is not expected to acquire Invitae anytime soon. An analysis of the financial details shows that this would jeopardize the increasingly strong position of the largest competitor.

- Quality of Revenue : Exact Science generates more revenue each quarter than Visitor does in a year. However, the biggest competitor reports lower operating losses, with operating margins lower by 30% for Exact Sciences and 170% for Invitae. The purchase will lead to an immediate deterioration in the quality of earnings.

- Money is everything: Exact Sciences will soon spend about $350 million on operating expenses in 2022, although about half of that amount was spent in the first quarter of the year. Invitae expects cash losses of at least $600 million in 2022 (less likely) and at least $225 million in 2023. The acquisition would double Exact Sciences' cash costs. In addition, the acquisition could cost close to a billion dollars, an amount that a larger competitor does not have. And the money could have been better spent elsewhere.

- PreventionGenetics : Exact Sciences made an acquisition to venture into the early detection of inherited cancers. But she won a small company. PreventionGenetics was already profitable. It may only generate $41 million in revenue by 2022, but it can expand quickly within the business infrastructure of its new parent company. Acquiring Invitee would not fit well with the current profitable growth strategy in this new business category.

Don't invest in rumours

It's easy to get caught up in speculation and excitement when investing in growth stocks. Of course, it's fun to imagine what would happen if you made the right bet that a failed business could be restored to its former glory.

However, Invitee's new management has made it clear that growth expectations will be limited at least until 2024. Investors have no reason to expect more than the projections.

Invitae could still be a takeover target for a larger party, eventually. But investors shouldn't expect Exact Sciences to be a competitor anytime soon.

Exact Sciences is on the verge of profitability with its existing product portfolio and development portfolio. For example, an updated version of Cologuard could come out in 2024. If it meets expectations, adjusted Ebitda may not be the right metric to judge the company by.

The new Cologuard could help the company achieve positive operating margins and cash flows by 2025 or 2026.

Simply put, the acquisition of Invitee by Exact Sciences will reduce the quality of the company's earnings and make profitable operations impossible for the foreseeable future. No amount of positive thinking can change that.

street smart

TheStreet's smartest scoop of the day

Delivered daily to your inbox with an exclusive newsletter on top investment topics, curated by TheStreet's premium content.

- beat the noise

- Your personal financial advisor

- Investment cheat sheet

Learn more