Life Sciences Inc.

Achieve life sciences, miss income expectations. EPS came in at $1.35 per share compared to the expected $1.13 per share.

Operator : Ladies and gentlemen, good afternoon, and welcome to the Life Sciences Third Quarter 2022 Revenue Call. All lines have been converted to Listen Only mode. The forum will be open for questions and comments after the presentation. In the meantime, I’d like to turn the floor over to your host, Nicole Jones, Investor Relations Specialist at CG Capital. Madam, you have the floor.

Photo by Yulia Koblitz on Unsplash

NICOLE JONES: Thanks operator. In today’s conversation with Axeve, John Bencic, CEO; and chief accountant Jerry Wang. After the prepared comments, Success Management will be available for questions and answers. I would like to remind everyone that today’s call contains forward-looking statements that are based on current expectations. These statements are only projections and actual results may differ from those anticipated. Please refer to Achieve’s SEC filings which may affect the company. I will now hand over to John.

John Bencic: Thank you, Nicole, and thank you to everyone who joined us today. Once again, the success quarter was a busy and exciting one. As we continue to push cytocycline through the clinic, we are poised to become the first new treatment for nicotine addiction in nearly two decades. In September, we announced the completion of targeted recruitment of participants for our Phase III ORCA-3 confirmation study on smoking cessation. And just last week, we announced that the Phase II trial of ORCA-V1 for nicotine e-cigarettes, or smoking cessation, completed better than expected. Of note, the ORCA-3 trial is the second and final phase III randomized trial that requires FDA submission and potential marketing authorization in the United States.

The design replicates the experience of the previous ORCA-2, which yielded excellent results earlier this year. Both trials were designed to evaluate the efficacy, safety, and tolerability of cytocycline 3 mg. The trials share the same primary endpoint for smoking cessation in the past 4 weeks, which is the primary endpoint for FDA-approved smoking cessation medications. The ORCA-2 results, if confirmed, would further solidify our belief that cyclicine could become the new gold standard in the treatment of nicotine addiction. Given the unequivocal incidence of side effects, the side effect profile of cycline is better than that of currently available therapies.

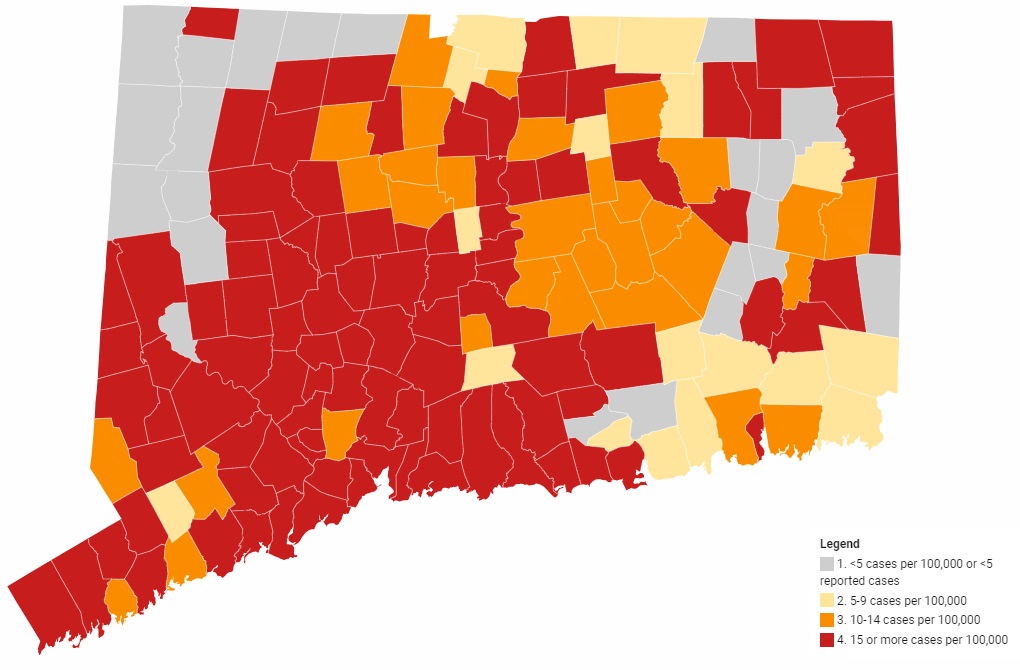

In terms of effectiveness, the odds ratio we observed with ORCA-2 at the end of treatment was six to eight times higher than placebo. Moreover, despite the high participation of the research team and the effectiveness of the trials during the outbreak, our dropout rate was extraordinary. We look forward to seeing similar results from ORCA-3 and look forward to sharing them with you in the second quarter of 2023. Vaping remains an important topic worldwide, especially given the alarming number of teens using it and the new evidence of harmful effects Potential on the cardiovascular system and respiratory system. More than 2.5 million middle and high school students in the United States alone use e-cigarettes, according to data released by the Center for Disease Control (CDC) last week.

More than 11 million adults in the United States use nicotine, and there is currently no approved treatment for smoking cessation. We initiated the ORCA-V1 trial expecting the steady cycle to be of benefit to this growing and overexerted population. The rapid recruitment of ORCA-V1 supports our hypothesis of a therapeutic need in this population. The target recruitment of 150 ORCA-V1 subjects was completed within four months, with recruitment completed at only five clinical trial sites. By design, ORCA-V1 will evaluate a 12-week course of citiccycline versus placebo. As with other ORCA studies, all participants will receive behavioral support during the study. The primary objective will be to assess successful nicotine withdrawal, defined as weekly abstinence from sex over the past 4 weeks, with cotinine levels as a biochemical evidence of abstinence.

ORCA-V1 data is expected to be available in the second quarter of 2023. After two test cases, we will focus on three main issues in the coming months. First, ongoing communication with the ORCA-3 and ORCA-V1 clinical trial centers and third-party clinical research organization to ensure data is accurate and timely. Second, careful preparation for the US NDA implementation, including successful results from the ORCA-3 trials, and completion of the remaining additional trials required for the application. Third, commercial readiness, including initiating preparatory activities and discussing partnerships with stakeholders with the greatest potential for citcycline.

We also continue to work closely with our manufacturing partner Sofarma to ensure there is sufficient commercial potential at launch as part of our commercial readiness objective. As we announced today, Sopharma recently invested over €3 million to complete construction of a new cytocycline API purification facility and main production facility in Sofia. The new API package complements Sopharma’s annual production of nearly three billion tablets. Now I’d like to take Jerry’s call regarding our third quarter financial results.

Also see Top 10 Widows and Orphans Stock Returns and Jim Cramer Stock Returns.

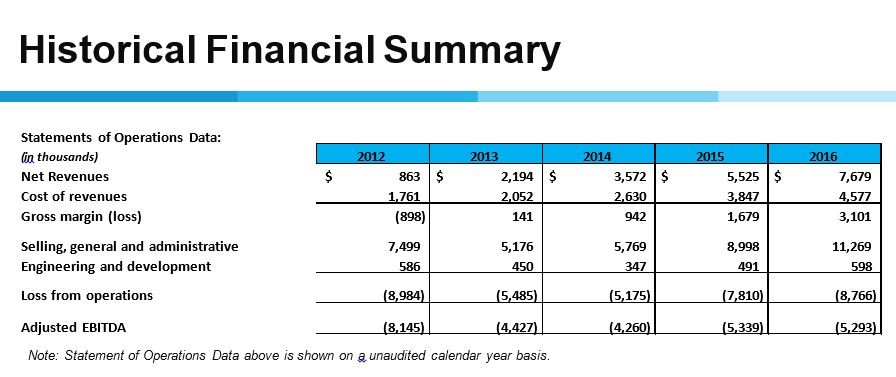

Jerry Wang : Thank you, John. I will provide an update on our cash position as of September 30, 2022 and review our operating expenses for the third quarter. As of September 30, 2022, cash and cash equivalents, short-term investments, and restricted cash were $18.2 million compared to $43 million as at December 31, 2021. Our financial projections include a $2.5 million grant from the National Institutes of Health. Supporting the ORCA-V1 phase II study to evaluate the use of cetirizine as a nicotine stopping agent for e-cigarettes. Of note, about half of the ORCA-V1 trials are funded by a grant from the National Institutes of Health. According to the income statement, net loss for the quarter ended September 30, 2022 increased to $13.1 million from $6.7 million for the same quarter of 2021.

For the nine months ended September 30, 2022, net loss increased to $31.1 million, compared to $26 million for the same period in 2021. Operating expenses increased in the third quarter due to the testing and operation of ORCA-3 and the achievement of planned acceptance. In our experience ORCA-V1. We expect our quarterly operating expenses to be higher in the fourth quarter of this year and then decrease in the first half of 2023 after the completion of the ORCA-3 and ORCA-V1 trials. This concludes my financial comment. I will now hand over to John.

John Bencic: Thank you, Jerry. 2022 is critical to success, with key milestones being the results of the Phase 3 trial and the completion of enrollments in two other major studies. We are excited to continue advancing our process and are committed to advancing this important new treatment. Cigarette and nicotine addiction directly affects more than 1 billion people worldwide. In the United States alone, more than 30 million people smoke cigarettes, and about 0.5 million people die from smoking-related diseases. According to the analysis, 80% of new smokers who want to quit smoking are interested in new smoking products.

We think it would be better for Cytocycline in the class, 93% of them want something new. Existing treatments are very troublesome for smokers and addicts alike, and new options are long overdue. Much more needs to be done to help people who want to quit smoking improve and extend their lives. At Cytocycline, we believe we have a unique opportunity and responsibility to make a real difference. Thanks again everyone for your continued support and for joining us today. Now I would like to transfer the call to the operator and open the line for questions.

Click here to continue reading the Q&A session.