Today, early detection of cancer is much more common than it was ten years ago. Exact Sciences ( NASDAQ:EXAS ) can't claim all the credit, but the non-invasive cancer tests it sells play an important role. About 4 million people will be screened for cancer by the company in 2021.

Despite its product's large audience, Exact Science's shares have fallen nearly 40% in the past year and are still below their peak of 56% in early 2021. Risky for most investors. Here's what you need to know.

Reasons to buy stocks in sound science

Exact Sciences introduces ColoGuard, a non-invasive colon cancer screening. It continues to channel Cologuard's revenue into innovative new cancer detection methods, including multiple cancer early detection (MCED) tests for the general public. Success in the highly sought-after MCED arena could push this stock higher, and Exact Sciences continues to move forward.

Last September, a blood test that tested 1,132 samples for four different cancer markers found that 61% of the samples had cancer. It is not very sensitive, but the lack of false positives is very reassuring. Exact Sciences also reported a specificity rate of 98.2%, meaning that almost all reported samples actually came from people with known cancer.

Exact Science's flagship test, ColorGuard, will soon receive an update called ColorGuard 2.0. In early 2022, the company tested samples from the Deep-Sea trial that led to the initial approval of ColoGuard using ColoGuard 2.0, and the results were very encouraging.

Investors worry about potential competition from Guardian Health 's ( NASDAQ:GH ) blood-based Shield test Fortunately for the exact science, last December's Shield test produced disappointing results that strongly suggest Cologuard 2.0 wins.

Reasons to be cautious

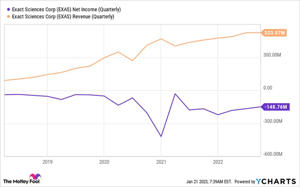

Sound science knows how to sell millions of cancer tests, but monetizing them is another story. The company continues to invest heavily in new initiatives such as the MCED program, which has not been successful. As a result, the company has been facing huge losses in recent quarters.

© YCharts EXAS Net Income (Quarterly)

© YCharts EXAS Net Income (Quarterly)

Young companies in the high growth phase often lose money trying to gain market share. Unfortunately, the exact science of cancer screening is stagnant. In the third quarter of 2022, the company's flagship cancer screening screened 960,000 people, just 10,000 more than the previous year.

Why now?

Exact Sciences is far from its previous peak, but there is still plenty of optimism at current prices. The stock is currently selling at 6 times. This is a relatively low figure for Exact Science, but surprisingly high compared to its larger rivals Quest Diagnostics and LabCorp , which trade at 1.7x and 1.6x sales, respectively.

Across different tests, Exact Sciences should maintain higher rates than LabCorp or Quest. Unfortunately, staying ahead of the competition requires such large investments that the company believes it won't be able to report adjusted earnings until the third quarter of 2023. In accordance with generally accepted accounting principles.

Brand loyalty is low in the diagnostic industry. Doctors usually choose the best test based on clinical trial data. Cologuard has done well, but it's always a matter of time before a good mousetrap is made. So I would not buy Exact Science or any other diagnostics company that is not already in steady growth in profits.

Sponsor:

10 stocks we love more than exact science

When our team of award-winning analysts have stock advice, it's worth listening. After all, the Motley Stock Advisor newsletter has doubled the market they've been operating for over a decade*.

They've just revealed what they think are the ten best stocks investors can buy right now…and exact science isn't one of them. That's right, they think these 10 stocks are a good buy.

Check out 10 promotions

* Stock advisor returns on January 9, 2023

Corey Renauer has no positions in any of the listed stocks. The Motley Fool has a position and recommends Guardian Health. The Motley Fool recommends Exact Sciences and Quest Diagnostics. Motley Fool has a disclosure policy.