![Life Sciences Market: [New Report] Strategy to 2023, Business Statistics, Growth Forecast to 2028 Life Sciences Market: [New Report] 2023 Strategies, Business Statistics, Growth Developments Forecast To 2028](https://timeswonderful.com/wp-content/uploads/2023/02/SCM-Trends-1.jpg)

The MarketWatch news department was not involved in the creation of this content.

Feb. 09, 2023 (The Expresswire) – "Analysis of the impact of COVID-19 on the industry will be added to the final report."

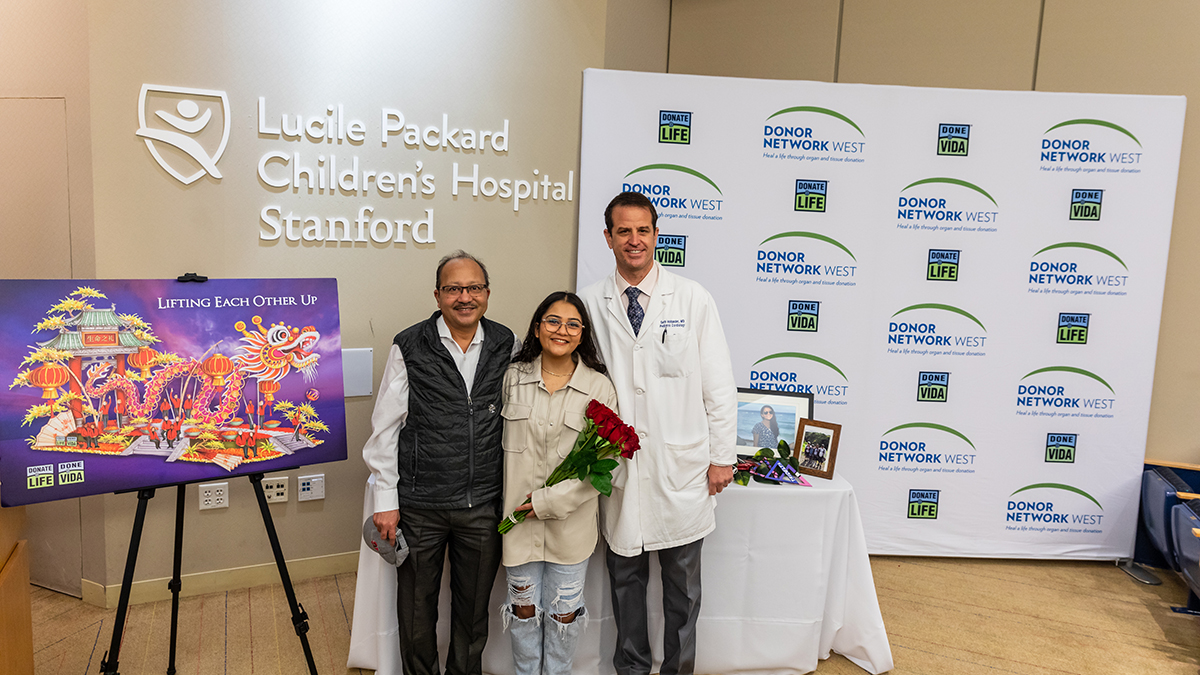

Global "Life Sciences Market" 2023-2028 provides comprehensive and high-quality information on innovative business growth strategies, macro and micro economic factors, trend assessments and key players' economic statements. This report (107 pages) provides a major roadmap of recent growth opportunities from major key players, as well as future business perspectives and developments. This report provides detailed information about the company as well as business plans and new investment ideas in all regions such as North America, Asia and Europe. In addition, Life Sciences market report provides share estimates as well as CAGR status, revenue growth data, industry size and segment analysis.

Get a PDF sample report at: https://www.marketresearchguru.com/enquiry/request-sample/22376440.

The global life sciences market size is estimated at $70,588.93 million in 2022 and the CAGR is expected to be 11.75% during the forecast period and reach $137,462.05 by 2028.

Combining comprehensive quantitative analysis and rigorous qualitative analysis, from a macro overview of the overall market size, industry chain, and market dynamics to micro-details of the market segmented by type, application, and region, the report provides a holistic view. Take a look at the vision, as well as a deep understanding of the life sciences market, covering all important aspects.

Major Key Players Covered in Life Sciences Market Report:

● Samsung Biologicals

● Thermo Fisher Scientific

● BGI Group

● Development of pharmaceutical products

● Saturdays

● Catalent pharmaceutical solutions

● AGC Inc.

● Content management system

● icon

● PerkinElmer

● Takeda Pharmaceutical Company Ltd.

● Boehringer Ingelheim

● Lonza Group

● Bio-Rad Laboratories

● Mark KGaA

● Selltrione

● PRA International

The report focuses on Life Sciences market size, segment size (which mainly covers product type, application and geography), competitive landscape, latest status and development trends. In addition, the report provides a detailed analysis of supply chain costs. Innovations and technological advances further optimize the performance of the product and make it more widely applicable in downstream applications. In addition, an analysis of consumer behavior and market dynamics (driving forces, constraints, opportunities) provides crucial information for understanding the Biotechnology market.

Get a Sample Health Care Market Report

In terms of the competitive landscape, the report introduces the industry players in terms of market share, concentration index, etc., and describes the leading companies through which readers can better understand your competitors and get a deeper understanding. Understanding. competitive situation. It also looks at mergers and acquisitions, trends in emerging markets, the impact of COVID-19, and regional conflicts.

Simply put, this report is a must read for industry players, investors, researchers, consultants, business strategists, and anyone in the market or planning to enter the market.

The main types of life science products covered in this report are:

● Knowledge management tools ● Data analysis platforms (structural and functional) ● Services

The most common downstream areas of the Life Sciences market covered in this report include:

● Medicine and health ● Academy ● Agriculture

Please read this report before purchasing or share your questions with us: https://www.marketresearchguru.com/enquiry/pre-order-enquiry/22376440

The report consists of the following chapters:

Chapter 1 mainly defines the market size and gives a macro overview of the industry, including brief overviews of various market segments (type, application, region, etc.) with definitions, market size, and related trends. market share.

Chapter 2 presents a qualitative analysis of the current state and future trends of the market. Barriers to enter the industry, market drivers, market challenges, emerging markets, consumer preference analysis, and the impact of the Covid-19 outbreak are explained in detail.

Chapter 3 discusses the current competitive situation in the market and provides information about the players, including their sales volume and respective market share, price and revenue, and gross margin. In addition, market concentration indicators, information about mergers, acquisitions and expansion plans are covered.

Chapter 4 focuses on regional markets and presents detailed data (eg sales, revenue, price, gross margin) for the most representative regions and countries of the world.

Chapter 5 provides an analysis of different market segments based on product type, revenue with sales volume, market share and growth rate, and price analysis for each type.

Chapter 6 provides a breakdown of various applications, including costs and revenues, market shares, and growth rates, to help readers better understand the recycling market.

Chapter 7 is a combination of quantitative and qualitative analysis of the market size and development trends for the next five years. The general background information along with the breakdown of the market gives readers an idea of the future of the industry.

Chapter 8 is an analysis of the entire industry chain of the market, key raw material suppliers and price analysis, an analysis of the structure of production costs, an analysis of substitute products, indicating the main dealers, downstream buyers, and the impact of the COVID-19 pandemic. .

Chapter 9 provides a list of the major players in the market along with their basic information, product profiles, market performance (e.g. sales volume, price, revenue, gross margin), recent developments, SWOT analysis, etc.

Chapter 10 concludes the report by helping readers summarize the main findings and points.

Chapter 11 presents market research methods and data sources.

To understand how the impact of Covid-19 is covered in this report : https://marketresearchguru.com/enquiry/request-covid19/22376440

Geographically, the report includes a study of production, consumption, revenue, market share and growth rate, as well as a forecast (2018-2028) for the following regions:

● USA ● Europe (Germany, UK, France, Italy, Spain, Russia, Poland) ● China ● Japan ● India ● Southeast Asia (Malaysia, Singapore, Philippines, Indonesia, Thailand, Vietnam) ● Latin America (Brazil, Mexico , Colombia ) ● Middle East and Africa (Saudi Arabia, United Arab Emirates, Turkey, Egypt, South Africa, Nigeria) ● Other regions

The report offers a comprehensive study of each segment and information on the leading regions in the market. This report also mentions import/export consumption, supply and demand, value, industry share, policy, price, revenue and gross profit statistics.

Key inclusions reflected in the Life Sciences Market Report:

● Information about dealers, distributors and dealers in the industry. ● Define, describe and forecast the MVR Vaporizer market by type, application, end user and region. ● Provide analysis of the company's external environment and PEST analysis. ● Provide companies with strategies to deal with the effects of Covid-19. ● Provide dynamic market analysis, including market factors and market development constraints. ● Provide go-to-market analysis, including market segment definition, customer analysis, distribution model, product positioning and messaging, and pricing strategy analysis for new or upcoming products. ● Monitor international market trends and analyze the impact of the COVID-19 pandemic on key regions of the world. ● Analyze the market opportunities of stakeholders and provide market leaders with detailed information about the competitive landscape.

The report offers a comprehensive study of each segment and information on the leading regions in the market. This report also mentions import/export consumption, supply and demand, value, industry share, policy, price, revenue and gross profit statistics.

This report answers several important questions:

● What is the size of the global life sciences market and its segments? ● What are the key segments and sub-segments of the market? ● What are the main drivers, constraints, opportunities and challenges of the life sciences market and how are they expected to affect the market? ● What are the attractive investment opportunities in the life sciences market? ● What is the size of the life sciences market at the regional and national level? ● Who are the main market players and their main competitors? ● What are the growth strategies of the main players in the life sciences market? ● What are the latest trends in the life sciences market? (MandA, partnership, new product development, expansion)? ● What are the growth challenges for the life sciences market? ● What are the key market trends driving the growth of the Biotechnology market?

Purchase this report (price $3250 for a single user license) – https://marketresearchguru.com/purchase/22376440

Detailed Life Sciences Market Forecast 2023-2028:

1 Health care market overview

1.1 Product Overview and Market Opportunities for Life Science Research Industry

1.2 Life Science Research Market Segment by Type

1.2.1 Global Healthcare Market Size and CAGR (%) Comparison by Type (2018-2028)

1.3 Global Life Sciences Segment by Application

1.3.1 Life Sciences Market Consumption (Sales Volume) Comparison by Application (2018-2028)

1.4 Global Health Sciences Market by Region (2018-2028)

1.5 Global Medical Sciences Market Size (2018-2028)

1.5.1 Global Life Sciences Market Outlook and Earnings Report (2018-2028)

1.5.2 Global Life Sciences Market Status and Prospects (2018-2028)

1.6 Global macroeconomic analysis

1.7 Impact of the Russo-Ukrainian War on the life sciences market

2 industry perspective

2.1 State and technology trends in the life sciences industry

2.2 Barriers to entry into the industry

2.2.1 Analysis of financial constraints

2.2.2 Analysis of technical barriers

2.2.3 Personal barrier analysis

2.2.4 Analysis of brand barriers

2.3 Analysis of Life Sciences Market Drivers

2.4 Analyzing challenges in the life sciences market

2.5 Emerging market trends

2.6 Analysis of consumer preferences

2.7 Trends in the biotechnology industry amid the COVID-19 outbreak

2.7.1 Overview of the global COVID-19 situation

2.7.2 Impact of the COVID-19 outbreak on the development of the life sciences industry

3 Global Biotechnology Market by Player

3.1 Global Health Sciences Revenue and Player Share (2018-2023)

3.2 Global Medical Sciences Revenue and Market Share by Player (2018-2023)

3.3 Average Price of Life Sciences Players in the World (2018-2023)

3.4 Global Medical Sciences Gross Margin by Player (2018-2023)

3.5 Biomedical Devices Market Competitive Situation and Trends

3.5.1 Life Sciences Market Concentration Ratio

3.5.2 Life Sciences Market Share of Top 3 and Top 6 Players

3.5.3 Mergers and acquisitions, expansion

4 Global Life Sciences Sales and Revenue by Region (2018-2023)

4.1 Global Life Sciences Industry Sales Volume and Market Share by Regions (2018-2023)

4.2 Global Health Sciences Revenue and Market Share by Regions (2018-2023)

4.3 Global Medical Sciences Sales, Revenue, Price and Gross Margin (2018-2023)

4.4 United States Medical Sciences Sales Volume, Revenue, Price and Gross Margin (2018-2023)

4.4.1 The US Life Sciences Market in the Context of COVID-19

4.5 Europe Biotechnology Sales Volume, Revenue, Price and Gross Margin (2018-2023)

4.5.1 The European life sciences market in the context of COVID-19

4.6 China Life Sciences Sales Volume, Revenue, Price and Gross Margin (2018-2023)

4.6.1 Chinese life sciences market under COVID-19

4.7 Japan Life Sciences Sales Volume, Revenue, Price and Gross Margin (2018-2023)

4.7.1 Japan Covid-19 Life Sciences Market

4.8 India Life Sciences Sales Volume, Revenue, Price and Gross Margin (2018-2023)

4.8.1 Indian Life Sciences Market under COVID-19

4.9 Southeast Asia Life Sciences Sales Volume, Revenue, Price and Gross Margin (2018-2023)

4.9.1 COVID-19

4.10 ল্যাটিন সায়েন্সেস ভলিউম ভলিউম, রাজস্ব, মূল্য এবং গ্রস (2018-2023)

4.10.1 COVID-19

4.11 মধ্যপ্রাচ্য জীবন বিজ্ঞান ভলিউম, রাজস্ব, মূল্য এবং মার্জিন (2018-2023)

4.11.1 Covid-19

5 গ্লোবাল সেলস ভলিউম, রেভিনিউ, এবং ট্রেন্ড ট্রেন্ড অনুসারে অনুসারে অনুসারে

5.1.

5.2

5.3.

5.4.

অ্যাপ্লিকেশন দ্বারা 6 লাইফ সায়েন্সেস বিশ্লেষণ বিশ্লেষণ বিশ্লেষণ বিশ্লেষণ

6.1

6.2 গ্লোবাল অ্যাপ্লিকেশন দ্বারা দ্বারা শেয়ার শেয়ার শেয়ার (2018-2023)

6.3 গ্লোবাল সায়েন্সের আবেদন দ্বারা হররা হররা হররা হররর 83-20র 1)

#7

7.1

7.1.1 গ্লোবাল এবং বৃদ্ধির বৃদ্ধির পূর্বাভাস পূর্বাভাস (2023-2028)

7.1.2 2023-2028

7.1.3 বৈশ্বিক প্রবণতা প্রবণতা পূর্বাভাস পূর্বাভাস পূর্বাভাস (2023-2028)

7.2 গ্লোবাল ভলিউম পূর্বাভাস পূর্বাভাস পূর্বাভাস অনুসারে অনুসারে (2023-2028)

202

7.4 বৈশ্বিক বিজ্ঞান ব্যবহারের দ্বারা া্বা 023 রবা 02 ্বদ

7.5 COVID-19

8 বটম-আপ বিশ্লেষণ

8.1. জীবন বিজ্ঞান

8.2

8.3 উত্পাদনখরচ

8.3.1

8.3.2

8.3.3 R&D

8.4 বিকল্প

8.5. জীবন বিজ্ঞান

8.6 জীবন বিজ্ঞান

8.7 জীবন উপর ডাউনস্ট্রিমে ডাউনস্ট্রিমে covid-19 এবং-ইউক্রেন যুদ্ধের প্রভাব প্রভাব প্রভাব প্রভাব প্রভাব প্রভাব প্রভাব প্রভাব প্রভাব প্রভাব প্রভাব প্রভাব প্রভাব

9 প্লেয়ারপ্রোফাইল

10 গবেষণা

11 পরিশিষ্ট

11.1

11.2 গবেষণাতথ্যেরউৎস

Content: https://marketresearchguru.com/TOC/22376440

যোগাযোগ করুন:

বাজার গবেষণা গুরু

Phone: USA +14242530807

যুক্তরাজ্য +44 20 3239 8187

Address: [email protected]

Source: https://www.marketresearchguru.com

আমাদেরঅন্যান্য প্রতিবেদন:

উচ্চ রক্তচাপের ওষুধের জন্য বিশ্বব্যাপী বাজার

বোট কভারিং মার্কেট

কোলেস্টেরল-হ্রাসকারী ওষুধের বাজার

বাণিজ্যিক নিমজ্জন ব্লেন্ডার বাজার

সার্চ ইঞ্জিন অপ্টিমাইজেশান পরিষেবা বাজার

ভার্চুয়াল প্রশিক্ষণ বাজার

প্রক্রিয়া নিরাপত্তা সিস্টেম বাজার

কনভেয়ার বেল্ট মার্কেট

ফ্যাটি অ্যাসিড বাজার

Supplements

দ্য এক্সপ্রেস ওয়্যার দ্বারা বিতরণ করা প্রেরি

দ্য এক্সপ্রেস দেখতে লাইফ সায়েন্স যান যান যান: [নতুন প্রতিবেদন] 2023-

COMTEX_424162242/2598/2023-02-09T11:26:03

এই প্রেস রিলিজ সঙ্গে একটি সমস্যা আছে? [email protected] উৎস আমাদের আমাদের গ্রাহক মাধ্যমে মাধ্যমে মাধ্যমে মাধ্যমে যোগাযোগ ৷ ৷ ৷ ৷ ৷ ৷ ৷ ৷ ৷ ৷ ৷ ৷ ৷ ৷ ৷ ৷ সাথে৷ ৷ ৷ ৷ ৷ মাধ্যমে মাধ্যমে মাধ্যমে মাধ্যমে মাধ্যমে মাধ্যমে মাধ্যমে মাধ্যমে মাধ্যমে

মার্কেটওয়াচ নিউজ এই তৈরির সাথে সাথে জড়িত নান