.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a .21 dividend.” />.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a

.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a .21 dividend.” />.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a

.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a .21 dividend.” />.21 dividend.” />.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a

.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a .21 dividend.” />.21 dividend.” />.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a

.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a

.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a  .21 dividend.” />.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a

.21 dividend.” />.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a

.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a

.21 Dividend” title=”BlackRock Health Sciences Trust (BME) announced a  .21 dividend.” />.21 dividend.” />.21 dividend.” />

.21 dividend.” />.21 dividend.” />.21 dividend.” />On April 3, 2023, BlackRock Health Sciences Trust's board of directors declared a regular monthly dividend of $0.21 per share ($2.56 per share). Previously, the company paid $0.21 per share.

To be eligible for the dividend, shares must be purchased prior to the ex-dividend date of April 13, 2023. Shareholders registered on April 14, 2023 will be paid on April 28, 2023.

At the current share price of $41.62, the dividend yield is 6.14%. Considering five years and running weekly samples, the average dividend yield is 5.85%, the minimum is 4.84%, and the maximum is 8.66%. The standard deviation of the results is 0.58 (n = 196).

The current dividend is 0.50 standard deviations above the historical average.

The company has a 3-year dividend growth rate of 0.07%, indicating that dividends have been increasing over time.

Learn how to receive dividends

Buy stocks. Holding shares. Selling shares. Repeat. This is share-buy content and you can easily create a share-buy calendar with Fintel.

What is stock market sentiment?

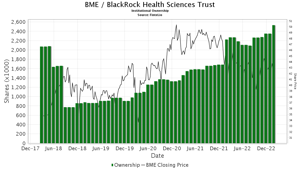

Black Rock Health Sciences Trust has 72 foundations or institutes. This is 10 owners more or 16.13% compared to the previous quarter. The average portfolio weight of all BME specialty funds is 0.25%, down 10.01%. Over the past three months, total institutional shares have increased by 9.73% to 2,521,000 shares.

What are other shareholders doing?

© Provided by Fintel BME/BlackRock Health Sciences Trust Stocks held by institutions

© Provided by Fintel BME/BlackRock Health Sciences Trust Stocks held by institutions

Elequin Capital owns 2,000 shares.

Wells Fargo owns 371,000 shares. There were no changes last quarter.

Mitra Eudaemonia has 9,000 shares. In previous filings, the company has 9,000 shares , up 0.11% . The firm increased its stake in BME Portfolio by 5.72% in the last quarter.

Advisor Group Holdings owns 90,000 shares. In its previous disclosure, the company disclosed that it holds 50,000 shares , an increase of 44.97% . Last quarter, the company reduced its BME portfolio by 72.86%.

Seamus Wealth Partners owns 13,000 shares.

Background Information BlackRock Health Sciences Trust

(This statement is provided by the company.)

BlackRock Health Sciences Trust (BME) (the "Trust")'s investment objective is to achieve total income through a combination of current income, current profitability and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing at least 80% of its assets in securities and derivatives related to the health sciences and healthcare industry under normal market conditions. The trust uses writing (selling) options to increase dividend income.

This story originally appeared on Fintel.