In this bear market, even the release of exceptional financial results has not been enough to prevent the stocks of many companies whose valuations depend on growth from falling significantly. The Nasdaq Composite Index (after falling further a few weeks ago) is down 29.4% from its all-time high, and many advance stocks posted bigger declines.

When a company's operations and stock performance diverge, it can offer high return potential for long-term investors. And if you're looking for such an opportunity, Airbnb ( NASDAQ:AIRBNB ) looks like a great buy right now. With shares trading around 53% off their peak, long-term investors can take a position in a great company at a price that opens the door to big gains in the future.

Airbnb advises long-term investors to be optimistic

In terms of business performance, 2022 has been an incredible year for Airbnb. Emerging from the crisis caused by the pandemic, the company posted its best ever financial results, and the strengths and promise of its model were on full display. The third quarter, which falls in the middle of the summer travel season, is typically the biggest driver of Airbnb's performance, and the quality of results during this period speaks to the strength of the company as a whole.

Despite currency headwinds and other challenges, Airbnb posted 29% year-over-year revenue growth in the third quarter to nearly $2.9 billion. In the third quarter, the number of nights booked through the platform increased 25% year-over-year to 99.7 million, total gross bookings increased 31% to $15.6 billion, and the company's quarterly gross margin was an impressive 86%.

Backed by catalysts in this direction, the leasing specialist's third-quarter net profit rose 46% year-over-year to nearly $1.2 billion with a 42% margin. As a result of foreign exchange headwinds, the company's net income increased 61% year over year in the third quarter.

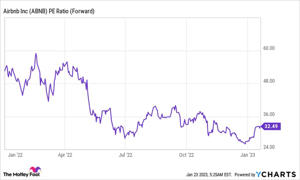

© YCharts ABNB PE Probability (Forward)

© YCharts ABNB PE Probability (Forward)

Airbnb stock trades at about 32.5 times forward earnings, which may seem overly sensitive to growth given the current volatile market environment. But the company's net profit for the trailing 12-month period was about $1.57 billion, which is much higher than the loss of $406.5 million in the same period last year.

Its free cash flow (FCF) valuation looks more attractive. Free cash flow grew more than 80% year-over-year to $960 million in the third quarter, and Airbnb generated more than $3.3 billion in free cash flow over the past four quarters, posting a 41% margin. With a current market capitalization of $64 billion, the stock trades at about 19.4 times trailing 12-month free cash flow; Given that free cash flow is expected to continue to grow in 2023, that's a pretty attractive valuation. on the horizon.

Long-term opportunities outweigh short-term challenges

In an increasingly challenging macroeconomic environment, Airbnb management expects revenue to grow 17% to 23% year-over-year in the fourth quarter. While this represents a significant slowdown in growth in the third quarter, it does not signal that the company's long-term growth trajectory is off track.

Like most businesses, Airbnb will face some challenges during a prolonged economic downturn, but it has already demonstrated the ability to flexibly respond to challenges while laying the foundation for profitable growth. The company has cut sales and marketing costs and taken steps to increase its inventory of walkable rural properties as it faces demand challenges amid social distancing and self-isolation during the pandemic. to avoid placement pressure in densely populated cities.

Airbnb's lean business model allows the company to respond quickly to changing market conditions, and the simple fact is that apartments and short-term rentals continue to be in high demand. Now that the company's valuation has been lowered to a level that allows for significant upside, and the company looks pretty solid overall, Airbnb stock is a solid buy for long-term investors.

SPONSOR:

Find out now why Airbnb is in the top 10 places to buy

Our team of award-winning analysts has been a market leader for over a decade. After all, the Motley Fool Stock Advisor newsletter they've been publishing for over a decade has tripled the market*.

You've just discovered the top ten stocks that investors can buy right now. Airbnb is on the list, but there are nine others you might want to overlook.

Click here for the full list.

* Fund advisor returns from January 9, 2023

Keith Noonan holds positions at Airbnb. The Motley Fool has a position on Airbnb and recommends it. The Motley Fool has a disclosure policy.