[ad_1]

While Samsung’s smartphone market share improved in the US in the first quarter of this year, its sales have dropped in India. It sold fewer smartphones nationwide, allowing Vivo and Xiaomi to overtake it. However, there’s good news in terms of revenue. The company sold more higher-end phones and earned the most among all smartphone brands.

Samsung sells fewer smartphones than Vivo and Xiaomi in India in Q1 2024

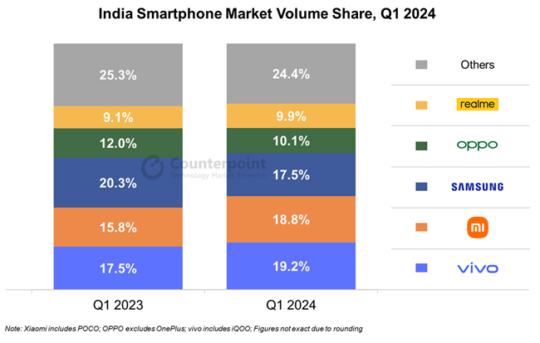

Samsung dropped from the first rank to the third in terms of smartphone shipments in India during Q1 2024. Its market share was 17.5% compared to 20.3% a year ago. Vivo ranked first with a shipment market share of 19.2%, a jump from 17.5% in Q1 2024. Xiaomi ranked second with a market share of 18.8% in Q1 2024 compared to 15.9% in Q1 2023. OPPO ranked fourth with a 10.1% market share, while Realme ranked fifth with a 9.9% market share in smartphone shipments. However, the full picture shows that Samsung was in a comfortable position when it came to revenue.

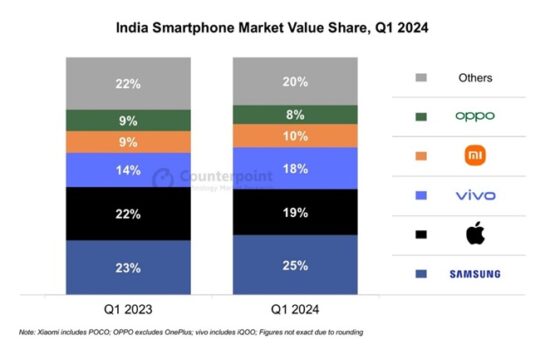

Samsung had a 25% share of the smartphone market revenue in Q1 2024. Despite ranking third in unit shipments, Samsung earned more revenue than any other smartphone brand in India. Its revenue share increased from 23% in Q1 2023 to 25% in Q1 2024. According to the report, the South Korean firm’s smartphone average selling price (ASP) hovered around $425, much higher than all its Android rivals. Higher sales of the Galaxy S24 (compared to Galaxy S23 sales from last year) helped it achieve that feat.

Watch our review of the Galaxy S24 in the video below.

Counterpoint Research reveals that smartphones priced more than INR 30,000 ($360) accounted for 20% of all smartphones shipped in India. Those 20% of phones (priced above INR 30,000) accounted for 51% of the revenue generated by the Indian smartphone market. According to the research firm’s survey, over 33% of mid-range smartphone users in India want to upgrade to a higher-end phone.

Apple also performed impressively. Despite not being ranked in the top five smartphone makers in terms of shipments, Apple earned the second-highest revenue in India. The iPhone maker earned 19% of the revenues, but that has dropped from 22% of revenue from Q1 2023. The research firm expects the Indian smartphone market to grow in single digits for the rest of the year, and good times are ahead.

Nothing grew 144% year-over-year, thanks to its new mid-range phone. Mot0rola’s shipments rose by 58% due to its smartphones’ stock Android experience and the value-for-money factor. Over half (53%) of smartphones sold in India used MediaTek processors, while 35% of phones sold in the country used Qualcomm Snapdragon chips.

[ad_2]

Source Article Link