In an era where our smartphones feel like extensions of ourselves, ensuring they last through our busiest days is a must. For iPhone users, the quest for longer battery life is ongoing, but thankfully, there are innovative shortcuts and automations that can significantly extend your device’s battery life. If you’re keen on making the most out of your iPhone’s battery, you will be pleased to know that with a few adjustments and the implementation of practical automation, you can significantly reduce power consumption without sacrificing functionality.

Stephen Robles has recently shared a video that sheds light on ten essential shortcuts and automations, designed to help iPhone users maximize their battery life. These tips range from automating the Low Power Mode to adjusting screen brightness and managing the always-on display. Let’s dive into these battery-saving tricks:

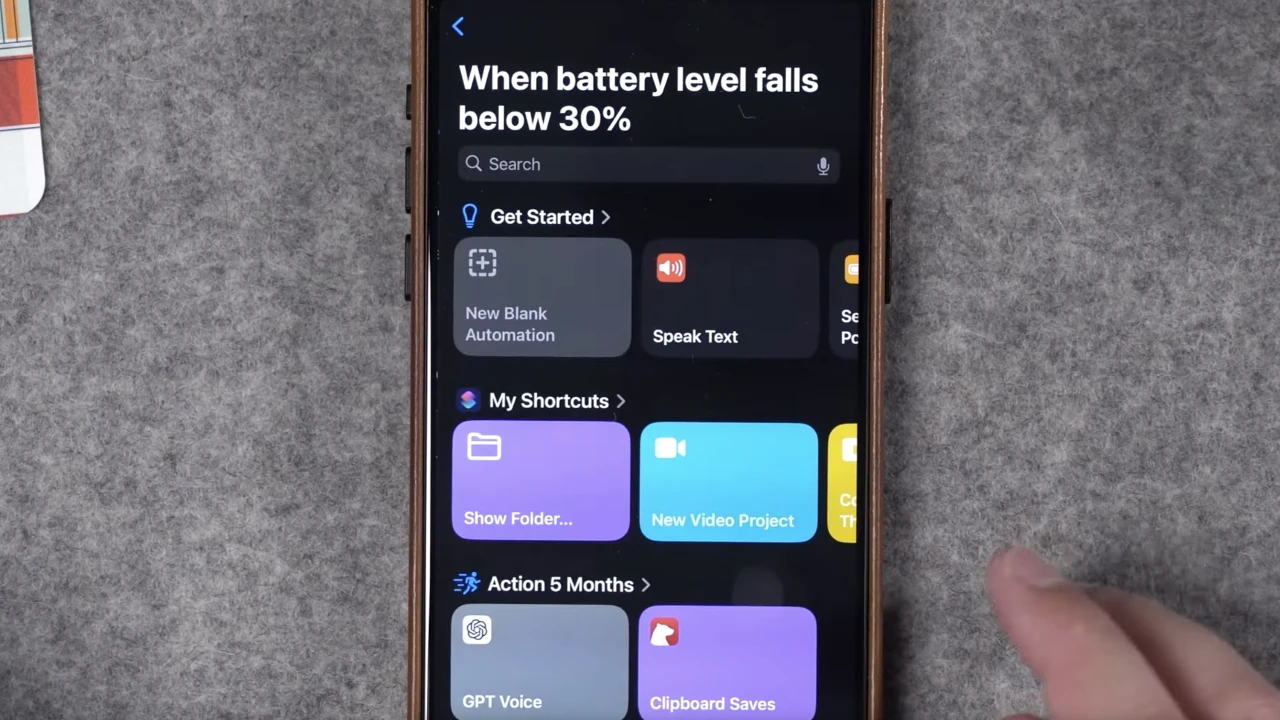

- Automate Low Power Mode: This feature can be set to activate automatically when your battery dips below 30% and to deactivate when the battery level climbs above 50% or the device starts charging. This ensures your phone conserves energy when it’s running low and returns to normal functionality once it has enough charge.

- Adjust Always-On Display Settings: For users of iPhone 14 Pro and 15 Pro models, you can automate your always-on display to turn off when the battery falls below 30% and to reactivate when the battery level exceeds 65%. This is particularly useful for saving battery while still enjoying the benefits of the always-on display when your battery level allows it.

- Screen Brightness Shortcut: Create a custom shortcut to manually adjust your screen’s brightness to around 8% and navigate to settings to disable auto-brightness. This manual adjustment helps in conserving battery by reducing the power used by your display, one of the most significant battery drains on any smartphone.

- Super Low Power Shortcut: For those times when you need to squeeze every bit of life out of your battery, this shortcut combines several actions: lowering screen brightness, enabling low power mode, turning off the always-on display, and disabling auto-brightness. This is the ultimate battery-saving mode for critical situations.

- Revert Settings Upon Charging: Set an automation that will revert all your energy-saving changes (like disabling low power mode, turning on the always-on display, and adjusting brightness) when the iPhone is unplugged from the charger. This allows you to return to your preferred settings automatically once your phone is charged.

- Audible Charging Notification: A clever automation to have Siri announce when the iPhone’s battery reaches 85%, giving you a heads-up that your phone is almost fully charged without needing to constantly check.

- Silence Mode Toggle: Specifically for iPhone 15 Pro and Pro Max users, this automation can turn off silence mode when the phone is charging and turn it back on when disconnected. This feature is great for ensuring you don’t miss important notifications just because your phone was charging.

These shortcuts not only enhance your iPhone’s battery life but also introduce a level of customization and automation that many users might not realize is possible. Implementing these tips can lead to a more efficient use of your device, ensuring it stays powered for longer without constant manual adjustments.

Robles concludes his video with a playful reminder to subscribe for more insightful tips on iPhone settings, emphasizing battery life, privacy, security, and tutorials on using shortcuts for other Apple devices. This blend of practical advice with a hint of humor makes the learning process enjoyable and memorable.

Adopting these shortcuts will not only extend your iPhone’s battery life but also enhance your overall user experience by automating tasks that would otherwise require manual intervention. It’s about making smart use of the technology at our fingertips to make our daily lives a bit easier and our devices more efficient.

Source & Image Credit Stephen Robles

Filed Under: Apple, Apple iPhone, Guides

Latest timeswonderful Deals

Disclosure: Some of our articles include affiliate links. If you buy something through one of these links, timeswonderful may earn an affiliate commission. Learn about our Disclosure Policy.