This article first appeared in the Morning Brief. Get your morning roundup delivered straight to your inbox Monday through Friday at 6:30am ET. customer

Wednesday, December 14, 2022

Today's newsletter is from Miles Woodland , Senior Market Editor at Yahoo Finance. Follow him on Twitter @MylesUdland and LinkedIn . Read this and other market news on the go with the Yahoo Finance app for Apple or Android . Yahoo Finance app.

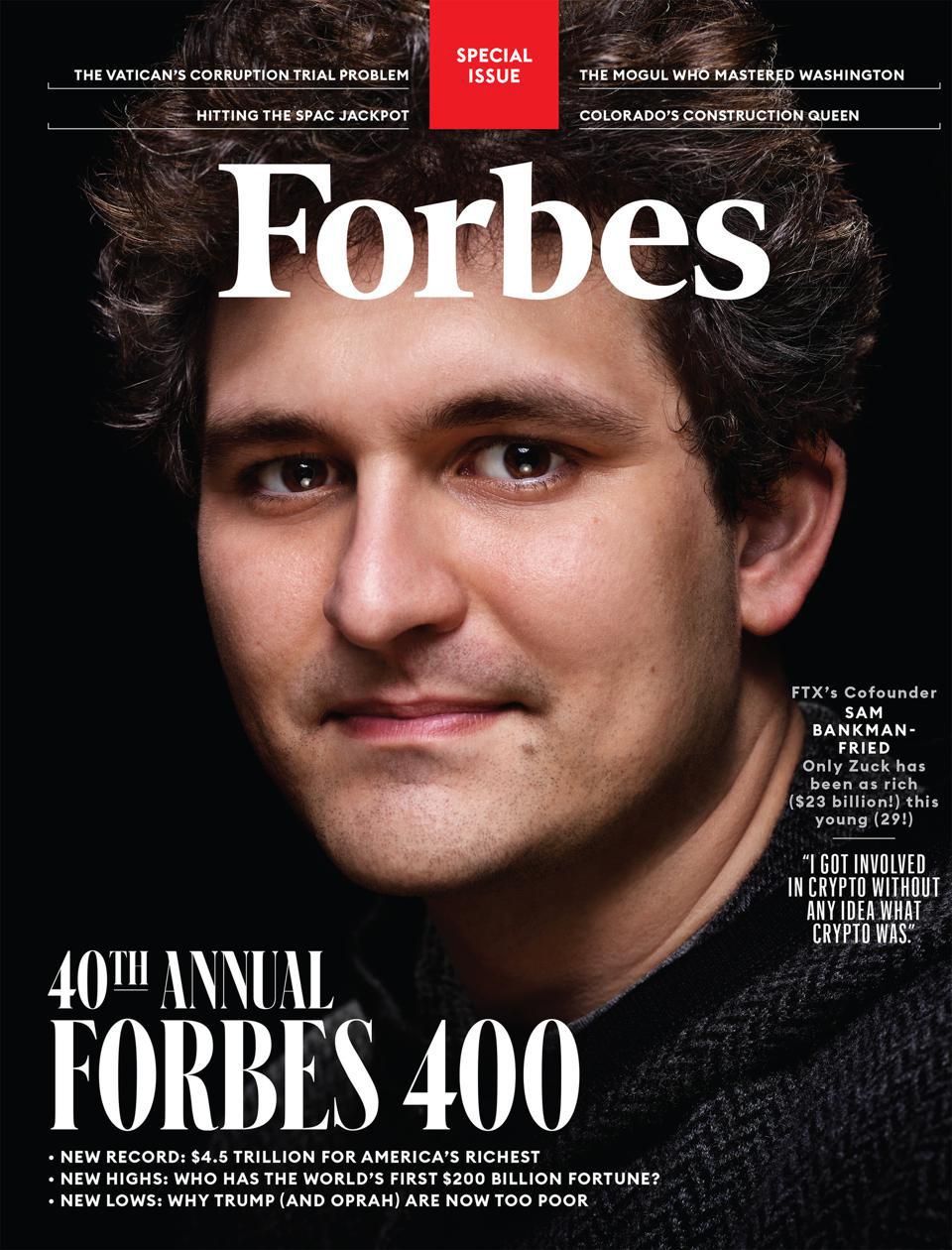

Sam Bankman-Fried, founder and former CEO of FTX, has had a rough week. Bad week after bad month.

Bankman-Fried, known in the cryptocurrency world as SBF, was arrested on Monday and charged on Tuesday by three different US authorities: the Department of Justice, the SEC and the CFTC.

According to the SEC's complaint, SBF alleged that the offshore crypto exchange was a scam, or as SEC Chairman Gary Gensler put it: "The house of cards [was built on a foundation of fraud], while investors were told it was one of the safe. cryptocurrencies."

During its brief tenure as an industry star, SBF was a regular presence in Washington. According to the Justice Department's complaint, SBF, along with "other known and unknown individuals," allegedly made campaign contributions that exceeded federal limits.

It seems that FTX's business is mainly to turn something that is not legitimate into something that is legitimate.

© Courtesy of Yahoo Finance. FTX USA CEO Sam Bankman-Fried attends a press conference at the FTX Arena in downtown Miami on June 4, 2021. (Matias J. Ocner/Miami Herald/Tribune News Service via Getty Images)

© Courtesy of Yahoo Finance. FTX USA CEO Sam Bankman-Fried attends a press conference at the FTX Arena in downtown Miami on June 4, 2021. (Matias J. Ocner/Miami Herald/Tribune News Service via Getty Images)

The cryptocurrency industry wants to disrupt the traditional financial world and quickly create new rules to strengthen its position in this world.

But just as Gensler and others argue that crypto regulation is a problem for the crypto industry, this year's event also shows that the problem for the crypto industry is not a problem for the world of crypto investors. It seems that this is the outcome that the SBF – and most others – would like to avoid.

In a hearing before the House Financial Services Committee on Tuesday, John J. Ray III was asked to answer for many of SBF's sins.

And while congressional hearings are always a political spectacle (what else could they be?), the tone of Tuesday's hearing was similar to what the cryptocurrency industry has struggled with in recent years, the skeptics' notion that cryptocurrencies fulfill their promises. one thing, then you will do another.

During the trial, Wray, who had overseen the liquidation of Enron amid the bankruptcies of other companies, made it clear that he had no interaction with SBF. Ray's job was not to defend or explain SBF, but to recover as much money as possible from customers and investors.

On that front, Wray was concerned, saying Tuesday, "At the end of the day, we're not going to be able to make up for all the losses here." Serious efforts by serious lawyers lead to serious failures.

© Yahoo Finance US FTX Group CEO John J. Ray III speaks during a House Financial Services Committee hearing investigating the collapse of now-failed cryptocurrency exchange FTX, FTX founder Sam Bankman-Fried on Capitol Hill in Washington, USA after his arrest on December 13, 2022. REUTERS/Elizabeth Franz

© Yahoo Finance US FTX Group CEO John J. Ray III speaks during a House Financial Services Committee hearing investigating the collapse of now-failed cryptocurrency exchange FTX, FTX founder Sam Bankman-Fried on Capitol Hill in Washington, USA after his arrest on December 13, 2022. REUTERS/Elizabeth Franz

Since the rapid collapse of FTX, a common cry in the cryptocurrency community has been where are the authorities and where are the regulators. They arrived on Tuesday.

For years, the cryptocurrency industry has been calling for more clarity on cryptocurrency regulation. Gensler emphasized that existing securities laws are clear, convenient and affordable for the industry to follow.

Meanwhile, due to the lack of clear regulations, especially of cryptocurrencies, we have witnessed the failure of several exchanges, the disappearance of approximately two trillion dollars in market value and the theft of millions of customer funds.

Nothing has shaken faith in the global banking system or the real economy, which itself outweighs any urgent need for regulators to try (or not) to impose new rules on cryptocurrency.

Another situation the industry wants to avoid.

Check it out today

The hospitality

-

7:00 a.m. ET: MBA mortgage applications for the weekend of December 9 (-1.9% vs. previous week)

-

8:30 am ET: Import price index , month over month, November (-0.5% expected, -0.2% month over month)

-

8:30 am ET: Import price index excluding oil , month over month, November (-0.5% expected, -0.2% month over month)

-

8:30 a.m. ET: Import price index , year-over-year, November (3.2% expected, 4.2% monthly)

-

8:30 am ET: Export price index , month over month, November (-0.5% expected, -0.3% month over month)

-

8:30 a.m. ET: Export price index , year-over-year, November (5.7% expected, 6.9% monthly)

-

2:00 PM ET: FOMC Interest Rate Decision (lower bound) , December 14 (expected 4.25%, 3.75% previously

-

2:00 PM ET: FOMC Interest Rate Decision (Move) , December 14 (4.50% expected, 4.00% previously

-

2 pm ET: Reserve balance interest rate , Dec. 15 (4.40% expected, 3.90% forward)

income

–

Click here for the latest new cryptocurrencies, updates, values, prices and more related to Bitcoin, Ethereum, Dogecoin, DeFi and NFT

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter , Facebook , Instagram , Flipboard , LinkedIn and YouTube