© Courtesy of Geekwire at the Bristol Myers-Squibb Lab in Seattle. (Photo BMS)

© Courtesy of Geekwire at the Bristol Myers-Squibb Lab in Seattle. (Photo BMS)

Seattle's life sciences workforce and federal research funding have grown rapidly since 2019, according to a new report from real estate firm CBRE.

The Seattle region ranked third among metropolitan areas for life sciences job growth, with 25% growth from 2019 to 2022. What's more, R&D jobs in the region grew by 39.3%. Only the San Francisco and Boston areas had faster job growth in this sector.

From 2019 to 2022, Seattle also had the largest increase in NIH funding of any urban region. NIH funding in the city increased by nearly 30%, reaching $1.39 billion in 2022. The University of Washington and the Fred Hutchinson Cancer Center were the top recipients of NIH funds, receiving $591.6 million and $473 million, respectively, of the .9 million received.

In 2022, life sciences funding in Seattle will top $600 million, compared to a record $1 billion in 2021. More than 1.6 million square feet of research space is under construction in the Seattle area, about a third of which is already overdue. .

RELATED: Biotech industry leaders share cautious optimism for 2023 amid economic slowdown and layoffs

"Companies in the Puget Sound region are approaching this year with cautious expectations," said Austin Arper, vice president of CBRE Life Sciences in Seattle.

"Continued economic uncertainty will slow real estate decision-making for most, but continued NIH funding of our leading research institutions will continue to drive innovation and growth in the industry," said Arper.

Seattle-based Life Science Washington recently released its 2022 Capital Investment Performance report, which lists 50 life sciences deals that have raised more than $1.19 billion for the state's industry. The team's report covers all pre-IPO deals and also includes non-venture fund investments, such as NIH campaign support and early stage angel investments.

VC deals for Seattle companies in 2022 included $93 million for Bonum Therapeutics, $96 million for Cajal Neuroscience, and $44.4 million for AltPep. Affini-T Therapeutics, which has offices in Seattle and Boston, received $175 million.

© Courtesy of Geekwire Life Sciences Venture Funding . (CBRE Graphics)

© Courtesy of Geekwire Life Sciences Venture Funding . (CBRE Graphics)

The US Life Sciences Outlook to 2023 report also assesses national trends.

The report concludes that the life sciences industry as a whole has returned to a "more normal pace" after rising in 2020 and 2021.

"Many indicators have declined from their 2020 and 2021 peaks, but are still above pre-pandemic levels. There is a lot of promising research that will drive this industry forward when lending conditions are met," said Matt Gardner, head of life sciences at CBRE.

Other information from the report:

- After surging during the pandemic, venture capital funding is now approaching pre-pandemic levels. In the first quarter of 2023, venture funding increased by 20% compared to pre-pandemic levels.

- The IPO market has cooled significantly. The total cost of the IPO exceeded $10 billion in 2021, but only exceeded $2 billion in 2022.

- Over the past decade, NIH's annual funding has increased by 62%.

- R&D spending by life sciences companies has increased by approximately 40% over the past five years.

- Last year, US life sciences companies amassed a cash reserve of $200 billion. It is lower than in the previous three years, but more than in 2018.

- Laboratory space in the top 13 US life sciences markets has grown 47% over the past five years and is expected to grow 22% over the next two years.

- Layoffs in the life sciences industry continue, with more than 50 companies announcing layoffs in the first two months of 2023 compared to the first two months of 2022. But overall, the unemployment rate among the life sciences was low, around 2%.

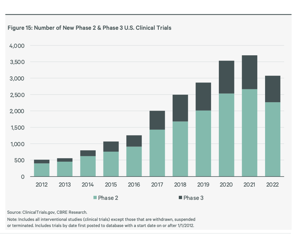

- Many potential treatments are in the pipeline. There are currently more than 11,500 ongoing Phase 2 and 3 clinical trials in the US, significantly more than in 2012.

© Provided by Geekwire The number of US clinical trials has increased dramatically over the past decade. (CBRE Graphics)

© Provided by Geekwire The number of US clinical trials has increased dramatically over the past decade. (CBRE Graphics)