[ad_1]

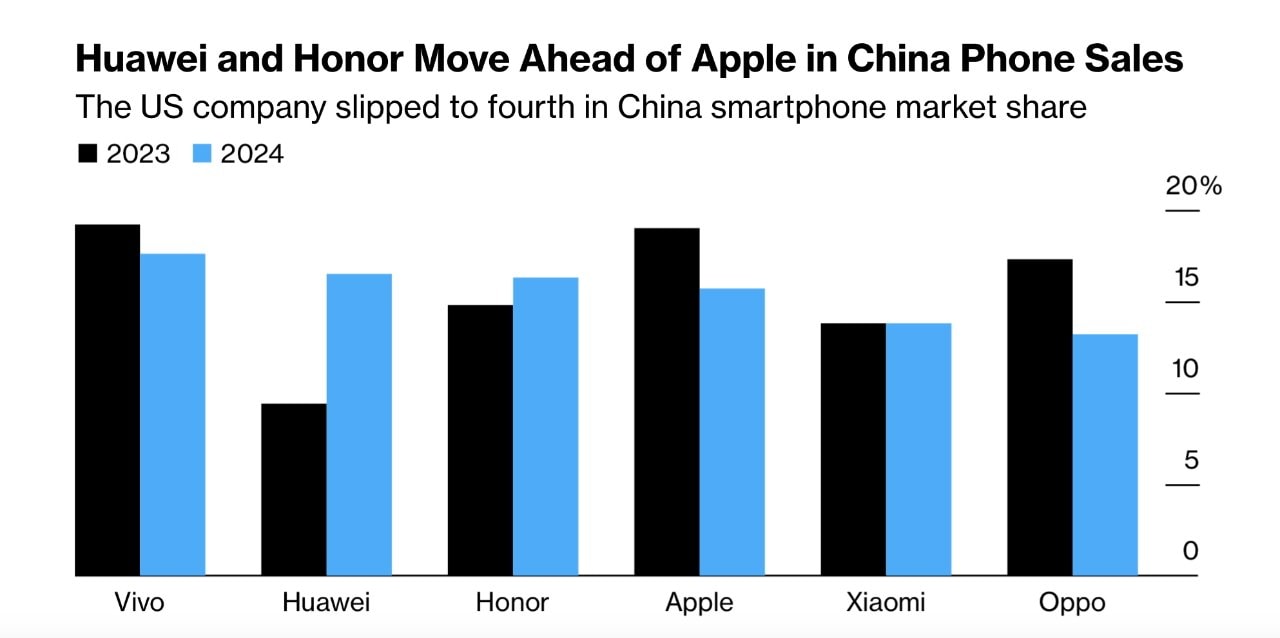

A flurry of iPhone market outlook reports shows Apple’s juggernaut handset is still the top-seller in Japan while slipping to fourth place in China so far in 2024. And that comes as Apple lowers component shipment targets for the year amid supply chain challenges, pointing to a possibly down year.

Reports: iPhone market outlook mixed amid sales decline and supply chain challenges

As predicted recently, iPhone sales are sliding in Asia so far in 2024 after a reasonably strong beginning and end to 2023. Various reports point to slowdowns and Apple reigning in iPhone component shipments.

China’s massive smartphone market slid 7% in the first six weeks of 2024. But in the same period, iPhone’s share dropped a whopping 24%. Why? Stiffening competition and sliding from a big high in January 2023, according to a Counterpoint Research report.

“Primarily, it faced stiff competition at the high end from a resurgent Huawei while getting squeezed in the middle on aggressive pricing from the likes of OPPO, vivo and Xiaomi,” said Counterpoint analyst Mengmeng Zhang.

“Although the iPhone 15 is a great device, it has no significant upgrades from the previous version, so consumers feel fine holding on to the older-generation iPhones for now,” they added.

Photo: Counterpoint Research

Stronger in Japan

Meanwhile, an International Data Corporation (IDC) report showed Apple has retained 49% to 51% of the market since 2022, a very strong first-place showing.

Japan’s smartphone shipments slid 3.5% year over year in 2023’s Q4, having recovered a bit from steeper declines in the first half of the year.

But iPhone shipments for the quarter increased 3.4% year over year as Android’s fell by 8.7%.

Overall, though, 2023 was a bit gloomy for smartphone shipments to Japan, falling by 11.6% compared to 2022. iPhone slid 6.1% while Android plummeted 16.3%.

Apple taps brakes on component shipments

The previous market consensus for 2024 iPhone shipments was 220-225 million units, and it has now started to fall, moving closer to my earlier prediction of 200 million units. If Apple can’t launch better-than-expected GenAI services this year, Nvidia’s market cap will very… https://t.co/t5r8TXXWl9 pic.twitter.com/lngF9oIkuB

— 郭明錤 (Ming-Chi Kuo) (@mingchikuo) March 5, 2024

And news of iPhone component shipment volume in 2024 is not particularly bright, so far.

Anaylyst Ming-Chi Kuo noted on X (formerly Twitter) and Medium that iPhone shipments could drop by 15% year over year because of structural challenges in the supply chain. He said Apple needs to launch “better than expected GenAI services this year” to keep up with smartphones from the likes of Samsung, or Nvidia might eclipse Apple’s market cap.

Apple may have biggest 2024 decline among major brands

Kuo echoed reports of Huawei’s resurgence and China’s love of folding phones as negatives for iPhone’s outlook, among his seven points:

- My latest supply chain survey indicates that Apple has lowered its 2024 iPhone shipments of key upstream semiconductor components to about 200 million units (down 15% YoY). Apple may have the most significant decline among the major global mobile phone brands in 2024.

- iPhone 15 series and new iPhone 16 series shipments will decline by 10–15% YoY in 1H24 and 2H24, respectively (compared to iPhone 14 series shipments in 1H23 and iPhone 15 series shipments in 2H23, respectively).

- The iPhone faces structural challenges that will lead to a significant decline in shipments in 2024, including the emergence of a new paradigm in high-end mobile phone design and the continued decline in shipments in the Chinese market.

China still loves folding phones

- The new high-end mobile phone design paradigm includes AI (GenAI) and foldable phones. The main reason for the decline in the Chinese market is the return of Huawei and the increasing preference for foldable phones among high-end users as their first choice for phone replacement.

- Benefiting from the higher-than-expected demand due to the high integration of GenAI functions, Samsung has revised up the shipments of the Galaxy S24 series in 2024 by 5–10%, while Apple has revised down the shipment forecast of iPhone 15 in 1H24.

- Apple’s weekly shipments in China have declined by 30–40% YoY in recent weeks, and this downward trend is expected to continue. The main reason for the decline is the return of Huawei and the fact that foldable phones have gradually become the first choice for high-end users in the Chinese market.

- It is expected that Apple will not launch new iPhone models with significant design changes and the more comprehensive/differentiated GenAI ecosystem/applications until 2025 at the earliest. Until then, it will likely harm Apple’s iPhone shipment momentum and ecosystem growth.

[ad_2]

Source Article Link