![]()

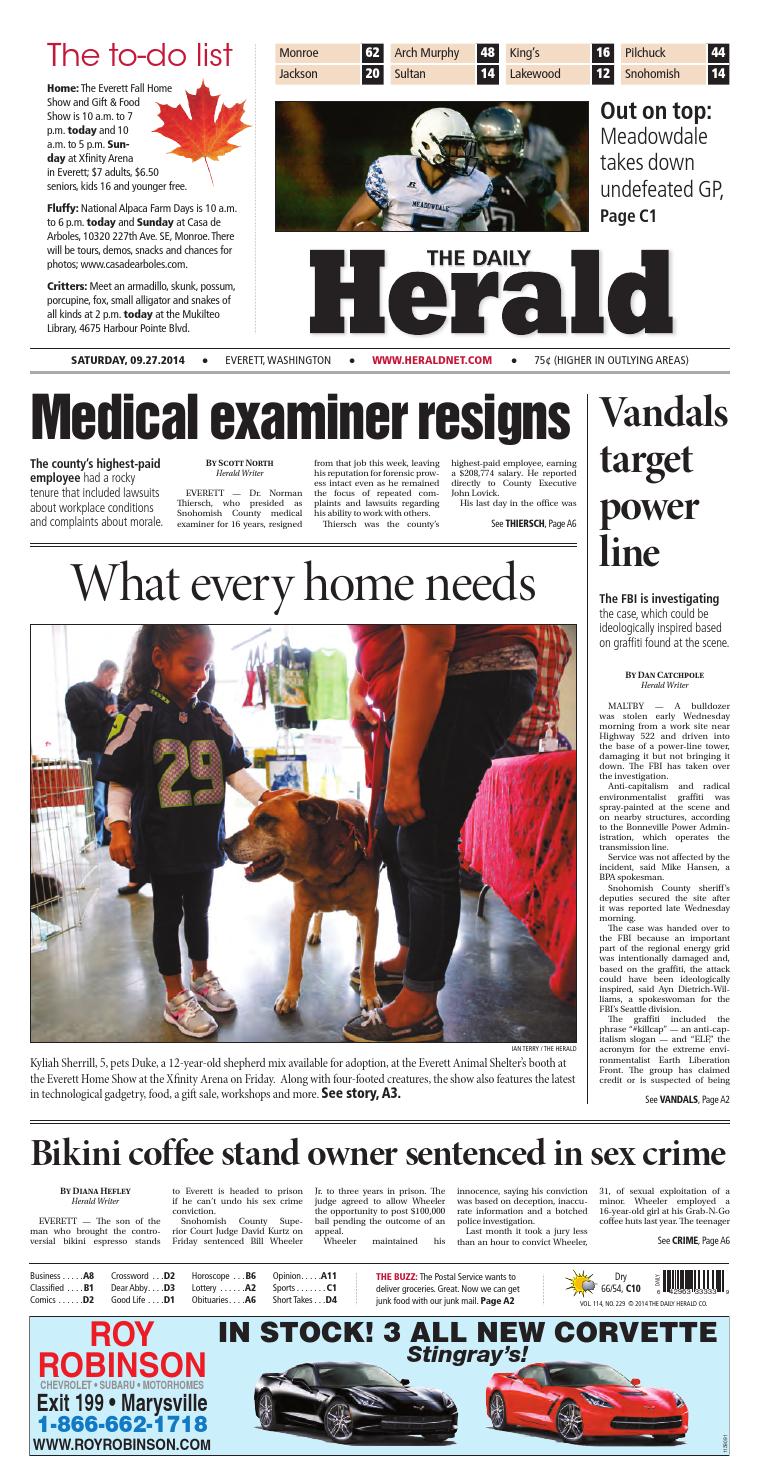

Toy company CEO Isaac Larian has made his fortune in the toy market over the past four decades by knowing what kids want to play with. Your job now also requires knowing what the big kids want to play with.

The founder and CEO of MGA Entertainment says that "kidding," the tendency for adults to increase demand for certain games, is one of the main reasons his company hopes to do so well with The 43rd Birthday Games.

Larian, who founded his first toy company in 1979, has seen the industry change from the time when Christmas toy sales relied on TV commercials scheduled a year before Christmas to today, when toy launches are announced on TikTok and appropriate viral videos. . Become a bestseller within hours.

The fourth largest toy company in the world and the second largest privately owned toy company after Lego, MGA is known for many businesses that include the innovative range of Bratz dolls, LOL Surprise dolls and accessories and the new line of Rainbow High dolls. . The company owns the Little Tikes brand of outdoor toys and vehicles.

This holiday season, TikTok's trend for adults creating and playing with miniature products and cooking complete miniature meals inspired MGA to create a line of toys that allow consumers to make shakes, pies, cakes, and other desserts. Based on the mini-pitch. links. which freezes after the completion of creation.

Small food containers contain items such as a small jar of whipped cream that can actually make a proper dollop of whipped cream, as well as cups, plates, and small containers for displaying the creations. One of the collections was launched at Walmart CDT This month.

MGA has also cemented the mini-toy trend made famous by Moose Toys Shopkins and toy maker Zuru earlier this year with the release of mini-versions of Bratz and Little Tikes.

![]()

According to Larian, MGA excels in the small space by creating functional and practical mini versions of games.

While he expects the mini-games to be popular with little ones, Larian is betting that most of the sale will be fun collectibles for older kids.

"Grown children are the driving force in today's toy business," he said.

He said that the income of adult children is higher than that of children. Millennials are nostalgic for the toys they played or dreamed of as kids, like Bratz dollhouses or Little Tikes basketball hoops. Mini versions of these games give them something to collect and view or play on TikTok.

Nostalgia for Bratz, the toy line that made Lorient famous in the toy industry, peaked this year and boosted MGA sales.

![]()

According to Larian, the brand turns 21 this year, a milestone on the anniversary of the doll's launch, and Bratz sales are up 100% this year.

TikTok has also helped promote the Bratz brand, with various challenges popping up to dress up like a Bratz doll, put on makeup like a Bratz doll, or see what you look like with a Bratz filter applied to your photo.

Bratz's TikTok was a game promoter's dream: content generated organically by TikTok users, not corporate marketers.

Larian founded his first toy company in 1979 called Surprise Gift Wagon. He then acquired the rights to sell miniature electronic versions of Nintendo games and changed the company's name to Micro Games of America. Later, when he came up with the idea for a doll called the Singing Bouncy Baby and a Walmart customer told him that no one would buy American Micro Games dolls, he changed the name back to MGA in 1996.

It turns out that adding entertainment to the title was visionary. The main manufacturer of toys, Hasbro she was Mattel not shiny Lego has pursued films and other entertainment activities associated with its brands in recent years. MGA got into the world of entertainment early on, making Bratz cartoons and movies. The company announced last month that it is taking its entertainment plans to the next level with the launch of its own content studio, MGA Studios. As part of the launch, MGA Pixel acquired Zoo0 Animation, an Australian animation studio.

"We've been in the entertainment business since the beginning, before it was great for game companies to call themselves entertainment companies," said Lorian.

![]()

In addition to taking advantage of current trends, Larian believes that MGA's selection of games in a wide price range gives it an advantage this Christmas, as inflation can affect Christmas budgets. Miniverse Bratz Little Tikes dolls and figures sell for under $10, and branded toys like LOL Surprise range in price from $5 to $200 for a large group.

Larian said that going private gives MGA more flexibility to cut costs.

"Our spending on food has increased by 23%, but I want to make sure that every kid who wants an MGA game or every family that wants an MGA game for the holidays can buy one," she said. . “So we didn't pass a lot of the increased costs onto consumers. We absorbed a lot of that. And that's the luxury of being private because you don't have to report your earnings every quarter.”

![]()

Unlike the past two Christmases due to the pandemic, Larian expects parents to go shopping later this month.

Last year, consumers bought games in October or November because they thought stores would run out. And now they are waiting, as before, two weeks before Christmas.

The toy industry, where the pendulum has shifted from supply chain shortages to surpluses for some brands in the past two years, is "going through a really big adjustment" this year, Lorient said.

But he sees the trick with the optimism that comes from 43 years in the gaming business.

"Christmas is always December 25th and I tell my retail customers they will always come," he said. “Some years have a few months, like last year. This year, I think it will be the last two weeks before Christmas.”