MarketWatch Picks has highlighted these products and services because we believe readers will find them useful; MarketWatch News employees were not involved in the creation of this content. Links in this content may earn us a commission, but our referrals are independent of any compensation we receive. to know more

Haley Sachs believes that financing often has a funny and absurd side. Indeed, a sampling of her Instagram account (@mrsdowjones), which has more than 320,000 followers, yields a wide range of posts and memes, including a photo of Kim Kardashian on her private jet: When your budget is avocado toast and iced, coffee is waiting, and suddenly she's private can afford a plane,” and the final clip Sachs exposes is that you can deduct the full value of a Mercedes G Wagon from your business due to an IRS loophole.

Although Sachs comes from a wealthy background—he was born into an Upper East Side family with a father who worked at Goldman Sachs—he says he's always been surrounded by wealth without even realizing it. "My parents were and still are very tight on money," he says. Instead of feeling safe, it left her feeling "helpless, anxious and confused."

So, after she was fired from her $43,000-a-year job — it was a 401(k) — but she said, "Do I need to know what that has to do with it?" remember: In 2019, he launched a digital content business that uses the language of pop culture and memes to explain the basics of personal finance. The company is called Finance is Cool and known on social media as Mrs. Dow Jones has more than 320,000 followers on Instagram, 16,100 on YouTube and 251,400 on TikTok. "I started the business for a younger version of myself," she says.

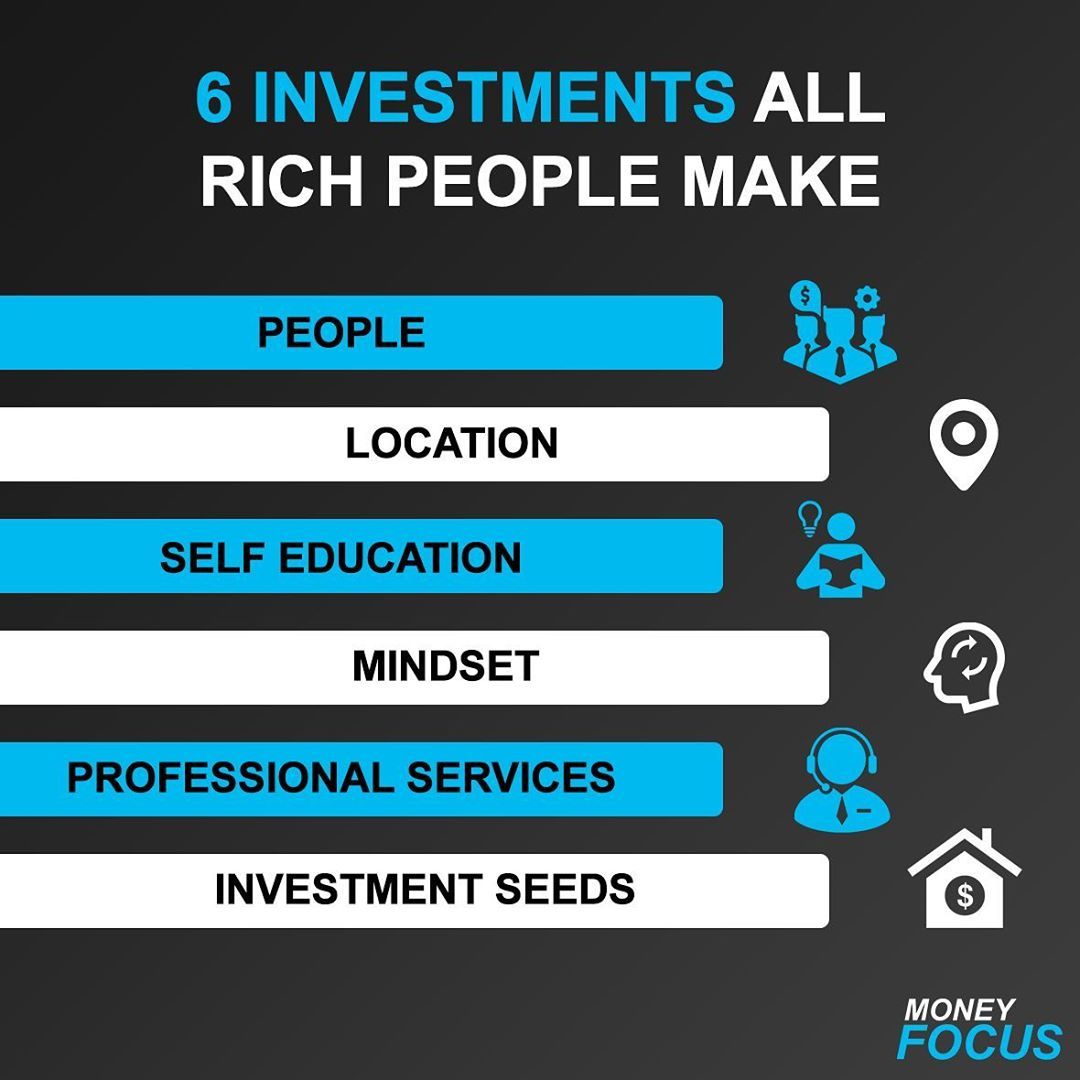

Some of his most popular writings are about his privileged upbringing. For example, in a recent post, she revealed that she paid $670 to lighten her hair at an Upper East Side salon. Offset the apparent advantage of these expenses by making videos like "Money Rules Only Rich People Know," which include the following six rules:

- Don't make so much money. ("Think of money as an asset, but never as a personality trait," he says.)

- Know where to spend it and where to save it. ("Always remember, nobody plays 24/7," he says.)

- Do not change anything until you use it completely. (When you consciously save for something and then you can buy it, you feel so good and love the product so much that you really want to take care of it, she says.)

- Be a little careless with money. (He notes that you want to have money in your life that you can be generous with.)

- Confirmed by check. ("If you invite someone somewhere, you're going to have to pay for it," she says, noting that this is true regardless of your gender.)

- Be so generous. (Whether it's paying for a cab or buying someone a drink, these small actions really do make a big difference.)

Sachs, who is now a spokesperson for Amex Rewards Checking, also teaches a series of personal finance courses that invite participants to become their own trust funds. And he dreams of starting a production company that will tell great financial stories. "I want to be Mrs. Dow Jones forever," she says. "And I want to bring people with me in the most transparent way." Here are three of the best savings tips he recently shared with MarketWatch Picks.

1. Automate your savings.

"Automation is literally forcing wealth into your future," Sachs said. This means you should set up automatic monthly or even weekly transfers from your checking account to your savings account so you don't have to remember to keep the money.

Sacks prefers high-yield savings accounts that are available somewhere other than the bank statements you regularly open to check your checking account balance. "If you don't see it every day, you forget it," he says. So you save money without thinking or worrying. This works especially well if you have a regular paycheck and a solid budget that allows you to put money away. (See the highest savings rates you can get here.)

2. Wait a week before spraying.

You just saw a great pair of loafers on sale at TheRealReal and you've always wanted them. Of course, they're on consignment, so they've already lost their value, and besides, if you don't buy them, no one else will? Maybe you should take advantage of the offer.

Hang in there, advises Sachs. "Don't rush to buy things you didn't plan on," he says. Most likely, within a week, the urge to click "Buy" will be a thing of the past. If not, use the money you would otherwise spend on something frivolous, like a nice dinner with friends or a new dress for an upcoming wedding.

3. Talk about money.

Sachs thinks you can relate to this story. You've been invited to a bachelorette party this weekend, and your bride wants to book a table at an expensive restaurant every night you're away. You know you can't afford it, but you don't want the hassle, so you go along with it, even if it means paying off high-interest credit card debt.

The way out, Jones says, is simply to hang out with friends. "We live in a culture of watching the Jones family," he says. (You're not included.) "You have to be able to express yourself or you're stuck in this cycle of reactive spending that's harmful."

Be honest in the group message that these types of meals are out of budget and then offer alternative recommendations. For example, a dive bar or barbecue at your rental home with good food and good music. "The more you own what you want and why you're doing it, the better your relationship will be," says Jones.